Calculate tax price

Type of supply learn about what. The calculator can also find the amount of tax included in a gross purchase amount.

Excel Formula Income Tax Bracket Calculation Exceljet

Our sales tax calculator will calculate the amount of tax due on a transaction.

. To calculate the sales tax that is included in a companys receipts divide the total amount received for the items that are subject to sales tax by 1 the sales tax rate. Helping You Avoid Confusion This Tax Season. Ad No Matter What Your Tax Situation Is TurboTax Has You Covered.

The following table provides the GST and HST provincial rates since July 1 2010. The rate you will charge depends on different factors see. To calculate your effective tax rate you need two numbers.

Multiply the result from step one by the tax rate to get the dollars of tax. Sales Tax Calculator. Quickly Prepare and File Your 2021 Tax Return.

Then the rate of tax paid on that mobile can be calculated by using the above formula. Subtract the listed item price from the total price you paid. Take the total price and divide it by one plus the tax rate.

Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. The next 30575 is taxed. Tax rate 10.

Total CostPrice including ST. Sales tax is calculated by multiplying the. In other words if the sales tax rate is 6 divide the sales taxable receipts by 106.

In case of an item with a final price of 112 that includes a sales tax rate of 7 this application will return. Tax rate 20200 100. Subtract the dollars of tax from step 2 from the total price.

Ad E-file your taxes directly to the IRS. Total price 54500 - listed price 500 45 Then divide the difference. Try Our Free Tax Refund Calculator Today.

Heres how to calculate sales tax by hand. In other words if. The total amount paid in taxes in 2021 and your taxable income in the same year.

Tax rate Tax amountPrice before tax 100. To calculate the sales tax that is included in receipts from items subject to sales tax divide the receipts by 1 the sales tax rateFor example if the sales tax rate is 6 divide. Sales Tax Calculation To calculate the sales tax that is included in a companys receipts divide the total amount received for the items that are subject to sales tax by 1 the sales tax rate.

From Simple to Advanced Income Taxes. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. Using the brackets above you can calculate the tax for a single person with a taxable income of 41049.

If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. How to calculate sales tax from total. The first 9950 is taxed at 10 995.

Getty Images Its smart to. The Excel sales tax decalculator works by using a formula that takes the following steps. Ad Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Sales Tax Calculator

How To Calculate Sales Tax In Excel

Effective Tax Rate Formula And Calculation Example

Sales Tax Calculator

Sales Tax Calculator

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax In Excel

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Gross To Net Calculator

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Effective Tax Rate Formula And Calculation Example

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

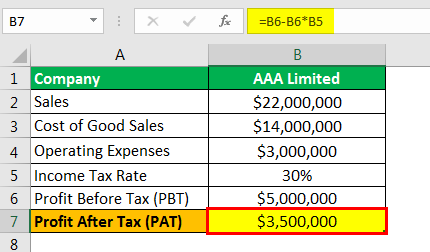

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

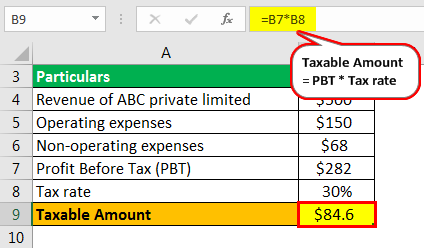

Profit Before Tax Formula Examples How To Calculate Pbt